I have practically run out of new tax havens to write about so it’s time to revisit some old articles, which I strongly feel are in need of some polishing. First in line is one of my personal favourites: Malta.

Overview

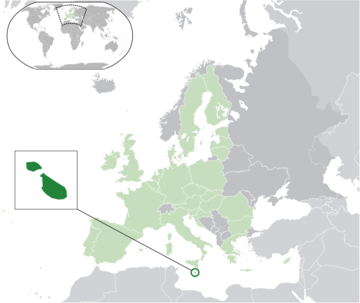

Malta is made up of a a couple of islands, mainly the island of Malta (which accounts for 77% of the area and 91% of the population), Gozo, and Comino (with its four permanent residents). It is tucked between the southern tip of Sicily and almost equal distances to Tunisia and Libya.

Despite its minute size and because of its strategically location, Malta has a very rich history. Practically all major socities or civilizations that have inhabited the Mediterranean have had presence in Malta and chances there are still echoes of them.

In 1964, Malta declared independence from the United Kingdom, becoming the State of Malta. It had thitherto been a crown colony since 1813. In 1974, the constitution was amended and Malta became a republic within the Commonwealth of Nations.

Malta’s history before 1813 is very interesting but also very convoluted. With many countries, it’s pretty easy to discuss their history either in broad strokes or in fine detail. With Malta, both are difficult because it got passed around between so many owners — sometimes as a gift, sometimes as a tribute, sometimes through conquest or uprising.

I may be biased because I spend a lot of time in Malta and have grown very fond of it.

| English name: | Republic of Malta |

| Official name: | Repubblika ta’ Malta |

| Population: | 445000 |

| Area: | 316 km2 |

| Region: | Europe |

| Official language(s): | Maltese, English |

| Other major languages: | None |

| GDP (PPP): | 16 billion USD |

| GDP (PPP) per capita: | 36,000 USD |

| Currency: | Euro (EUR) |

| Government: | Parliamentary republic |

| Indepence: | September 21st, 1964 |

| Legal system: | Mixed common law (English) and civil code (Roman and Napoleonic) |

| Tax system: | Worldwide, Remittance |

| FATCA: | IGA Model 1 |

| CRS/AEOI: | Yes (2017) |

| OECD Rating: | Largely Compliant |

| TIEA: | 5 |

| DTC: | 76 |

| FATF 40+9: | Compliant |

| FATF AML Deficient: | No |

| Corruption Ranking: | 47 (of 176) |

| Narcotics Majors List: | No |

| Fragile States Index: | Very Stable (39.6) |

| Basel Index: | 17 (of 149) |

| Financial Secrecy Index: | 50 |

Tax System

The Maltese system is such a special case that it needs its own headline before anything else. In no way is this a comprehensive explanation of how taxes work in Malta. You will probably need a tax adviser if you are thinking about using Malta to reduce personal or corporate taxes.

First of all, all persons are treated equally for income tax. That is, both natural persons (humans) and legal/juridical persons (companies) are subject to the same income tax legislation. But the tax rates are different and interpretation of laws are effectively different between natural and legal persons.

Second, Malta is one of very few jurisdictions to tax on remittance and domicile basis, although tax residence plays a significant role as well.

Domicile

Domicile is an intentionally vague concept. In practice, it is defined by looking at things like where a person is from (culturally, emotionally, family heritage), where a person intends to one day die and be laid to rest, and generally where a person belongs. For most foreigners with no family in Malta or Maltese at-birth citizenship, it’s enough to claim you have no intention of staying in Malta forever and you can qualify as non-domiciled.

Citizenship obtained through investment or residence doesn’t necessarily exclude one from remaining non-domiciled, although it does open you up to additional screening and consideration if questioned.

Residence

Residence is used as one factor when determining someone’s tax status. Generally speaking, if you live in Malta or if you are a legal entity which is incorporated in Malta or which has its operations and management in Malta, you are tax resident there.

Income Tax

Companies are taxed a flat rate of 35% on their profits. I will return to this later because as you can guess, Malta wouldn’t be one of the finest tax havens in the world if it were keeping 35% of companies’ profits.

Income tax on natural persons in Malta is progressive and goes from 0% to 35%.

However, if you are a foreigner and have a specialized profession with a salary over circa 84,000 EUR, you might qualify for the Highly Qualified Persons scheme with a flat 15% income tax. Chances are you would find this out from your employer and not from reading here, but maybe you stumbled upon this blog when looking for a new job and Malta sounded interesting.

Malta Incorporation and Business

General

It’s relatively easy to form a company and start a business in Malta. Easy, but not fast. The whole process generally involves a a lot paperwork than jurisdictions that have streamlined the process more, such as UK.

Once all the paperwork is filed with the MFSA, the company is usually formed in a couple of days depending on workload. I have seen same-day incorporation on a couple of occasions.

Obtaining a VAT number can take up to two months, so plan accordingly if you are starting a business that needs a VAT number.

Malta is one those jurisdictions where I would strongly and broadly recommend that you only use local corporate service providers. (The exception would be large, reputable multi-national service providers.) Starting a business in Malta is much more intricate than starting a business through an IBC-like entity. Chances are you will need local expertise.

Taxation

With one of the absolutely highest corporate tax rates in the world at 35%, you’re not the first to wonder why Malta keeps being classified a tax haven.

The trick is how it’s applied and, rather, how much of it you can get back.

Now, it’s out of the scope of this blog to discuss minute details of how tax laws work. In essence, though, if a Maltese company is owned by a non-domiciled shareholder, such as a foreign holding company, this shareholder can claim much of the taxes back.

The most common structure is that the Maltese trading company is owned by a foreign holding company. In this example, the Malta trading company would pay 35% and the foreign holding company would claim most of it back, for an effective tax rate of 5%.

That makes it the lowest effective normal corporate tax rate in the EU/EEA, not counting the special non-residence regimes of Gibraltar and Cyprus. And you can be resident in Malta while using this structure. As long as the ultimate shareholder is non-domicile, they can be resident in Malta all they want.

This is the point where I remind you that STREBER Weekly does not actually offer any tax advice.

Reputation

Malta has a generally excellent reputation. Its only significant reputational blemish is that it’s occasionally deemed a tax haven. However, it’s EU membership and strict compliance with international standards of transparency and cooperation keep Malta away from black lists.

Sometimes, people don’t know what or where Malta is.

Regulator

The MFSA oversees and supervises the corporate service sector. However, it is entirely possible and lawful to set up companies through someone who isn’t accredited by the MFSA.

Types of Legal Entities

There are a few different kinds but in reality, it’s rare to find something other than private limited company being used.

Bearer Shares

Not issued.

Record Keeping and Audit

All companies are required to keep records and all companies must submit to an annual audit, similar to for example Hong Kong. Some find this off-putting, whereas others accept or even embrace it. I see it as a necessary evil. It adds an operational and financial burden, but in return you can leverage the reputational advantages of being an audited company when applying for bank accounts, credits, loans, or otherwise engaging in business that requires due diligence.

For smaller companies, audits are often performed by an off-shoot of the same company as helped you set up the business. Fees start at just under 1,000 EUR and go up as your business transactions and complexity scale.

For accounting, you’re probably better off outsourcing; very often to the same company that helps you form your company. Fees vary a lot from 20 to 50 EUR per hour, depending on complexity and number of transactions involved. Some have a fixed minimum, some don’t. It’s usually negotiable and it can pay off to shop around.

Public Records

Directors, shareholders, and a number of other appointments are available for free and online via the MFSA Registry of Companies. Nominees and holding companies are often used, whether for tax or privacy reason.

In the case of holding companies, it’s up to the public records of that jurisdiction what information is ultimately made public.

Banking in Malta

General

Banking in Malta is suitable for personal banking and corporate banking alike. Non-residents are generally welcome but IBCs and other such offshore companies face hurdles and are often turned down.

Regulator

Banks are regulated by the MFSA, which is easily one of the most responsive, pragmatic, and nimble financial service authorities in the world today.

As I mentioned under Incorporation, some systems within the MFSA aren’t electronic or fully interconnected yet. If this doesn’t get resolved in the next couple of years, the MFSA might lose some its charm and favour.

Malta Banking License

Follows the same principles as all EU member countries, which I will get to in a future article.

Open a Bank Account in Malta

While it’s nowhere near as bad as Panama, opening a bank account in Malta is becoming increasingly difficult. The authorities work hard to keep away criminal elements and money laundering. In part, this is required where the banking sector is heavily used by financial service providers and gambling operators (online and offline).

Be patient and be cooperative. I have so far not seen Maltese banks ask for anything outrageous.

It’s usually not a problem to open a bank account for a local company (whether controlled/operated from Malta or not). Foreign companies will find it more difficult, especially those incorporated in shady tax havens and secretive offshore jurisdictions. BOV used to be easy-going here but have tightened up a lot recently.

Personal accounts for residents are pretty easy, even if many expats complain about being treated like criminals when they come to Malta. It can be hard to get credit cards without 100% security deposit as a new arrival in Malta.

Personal non-resident bank accounts in Malta are opened and in some cases can be done fully remotely, although your chances of success will improve drastically if you pay the bank a visit in person.

The banks are generally good, with reasonable fees, and sophisticated, modern internet banking. Two-factor authentication is well established, sometimes a bit overbearingly.

Banking Secrecy

There is no nor has there ever been any noteworthy banking secrecy in Malta. Authorities can easily compel banks and financial institutions to disclose information about account holders.

If you want to hide money, Malta is probably not where you’d do it.

Both CRS (AEOI) and FATCA are in place.

Banks in Malta

There have been 29 banks (credit institutions) licensed in Malta, of which two have surrendered their license and one has been revoked. Nemea Bank is still technically licensed even if the MFSA has recommended its license be revoked.

Of the active banks in Malta, some are worth mentioning in this context:

- Banif – a very confused bank that some corporate service providers still insist on working with. It’s not a bad bank as such. They have ownership and management problems, though.

- Bank of Valletta (BOV) – a long-standing favourite of mine. They have tightened controls recently and made it a lot more difficult to open accounts.

- HSBC – in Malta, the H in HSBC stands for Headache.

- Mediterranean Bank and MedCorpBank – a pretty good bank but limited in their services (still no cards, last I checked). Higher fees, but they are still quite receptive of offshore companies.

- Satabank – very young, very promising bank. Compliance is tight but pragmatic. Known for its close ties to the popular EFI LeuPay.

- Sparkasse – used to be a bit of a maverick, taking on all sorts of clients and turning a blind eye to compliance breaches. They have improved their controls and lost clients as a consequence, including some good clients that don’t like the bank’s new personality.

Nonetheless, Malta is not a jurisdiction where large sums of wealth are stored. I have had many clients grow significant wealth in Malta and once their personal assets start exceeding one or a few million EUR, I very often end up placing them with banks in for example Switzerland, Dubai, or Singapore that are better suited for long-term maintenance of wealth (whether it be private banking or just the peace of mind that a Maltese bank can’t offer).

Igaming (online gambling)

Malta operates one of the world’s finest igaming legislations. Hundreds upon hundreds of gambling operators and gambling websites, some holding their own license and many being white-labels that use someone else’s license, are based here. Some parts of the license application and maintenance procedures are a bit archaic and stiff, failing to be as pragmatic as for example UK and a handful other jurisdictions.

The MGA (Malta Gaming Authority) is a responsive and responsible overseer. Arguably, though, there is a conflict of interest in that the MGA is responsible both for licensing and for the enforcement of the gambling law. While player complaints are treated seriously and operators don’t like getting complaints notifications form the MGA, nearly all disputes are settled in the operators’ favour, even when it isn’t obviously the case. Still, the MGA is far better than many regulators in the online gambling world.

There is a threat on the horizon for the MGA and Malta, with more and more jurisdictions in the EU enacting local licensing regimes. UK, France, Spain, Italy, Belgium, Denmark, Ireland, and several others now require that operators hold a local license. While many operators in Malta are getting or already have such licenses yet still operate from Malta, it chip away some at the MGA’s revenue. Nonetheless, the MGA and igaming in Malta continue to grow year on year.

Igaming has made a strong impact on Maltese society, with thousands of foreigners (mostly North European) having settled on the island. It has created a boom in services and entrepreneurship that likely would not have come as quickly otherwise to Malta.

Living in Malta

Residence Permit

If you carry an EU, EEA, or Swiss passport – congratulations. You can just pack your bags, book a flight, and set up shop in Malta.

For non-EU citizens, there are quite a number of ways for highly skilled workers and entrepreneurs to relocate to Malta.

- EU Blue Card

- Economic Self Sufficiency

- Employment/Self Employment

- Long Term Residents

Head over to Identity Malta for more information.

Citizenship

Under the Individual Investor Programme, 650,000 EUR and some spare change in administrative and legal fees will get you a Maltese passport with full EU mobility. There is some debate as to whether you can vote in local elections; many of the locals prefer that you don’t.

This programme has been equal parts successful and criticized. The population is quite divided on the issue, with many seeing their nationality cheapened and others recognizing that its bringing revenue to the government.

Identity Malta is tough on compliance and turn down suspect applications. The whole screening and application process takes a couple of weeks to a few months depending on how much additional documentation is required.

As a general suggestion, avoid working with non-Maltese service providers if you plan to obtain Maltese citizenship by investment. You’ll want to go right to the source on this one and preferably one of the biggest and most well-established firms. Some shady reseller sitting in Latvia operating through a Seychelles company isn’t going to be childhood friends with a compliance officer at Identity Malta.

Otherwise, citizenship can be obtained through residence after five years or fast-tracked if you have family ties to Malta (including marriage). The turnaround time for these applications can be months or even years.

Taxation

With the right structure, it is possible to live in Malta as an entrepreneur and pay very little tax.

If you hold a salaried position with an employer earning at least 82,353 EUR per year and you qualify under the Highly Qualified Persons Rules, you can still enjoy a very favourable 15% tax rate.

But even at normal tax rate, it’s well below EU average.

On top of this are a number of concessions for foreign incomes, passive incomes, and foreign passive incomes that all together can make Malta very attractive for nearly every situation.

Final words

Don’t come to Malta if you want to live tax free through shady offshore companies and bank accounts shrouded by impenetrable banking secrecy. Not that you couldn’t do it in Malta. You can because controls on foreigners is pretty lax. Rather, don’t do it because there are perfectly legal and relatively simple means to achieve an almost tax-free life in a country that’s easy to migrate to for EU/EEA nationals and where the sun shines 300 or so days a year.

Although Malta has lapses when it comes to disclosing ownership, it is also not a place where you can expect significant secrecy comparable to the likes of BVI or Cayman Islands. Malta is close to fully compliant with EU recommendations.

Compliance can be a headache in Malta, but it’s how the island keeps its reputation so (mostly) nice and clean. It doesn’t want to become Cyprus. Have all your papers in order and be prepared to have to get more.

Come to Malta with your legitimate business or wealth, structure it correctly, and you can enjoy a very comfortable life.

Leave a comment

You must be logged in to post a comment.