But first

Let’s address the elephant in the room first: the dormancy of the blog. I have ideas for blog posts but limited time in which to write them. I don’t want to sacrifice on quality by sticking to a schedule so for the coming months, the blog will probably be responsive and reactive (i.e. writing about stuff as it comes to me based on discussions on forums and elsewhere) as opposed to writing about something new every X days/weeks.

Today’s post started out as a response to a thread by @Raphael in which the following question was posed: Which IBCs/LLCs do Georgian Banks go with? What started out as a short answer because a small treatise and I decided to share it here instead.

Categories

With the usual caveat that everything varies depending each unique situation and there’s no silver bullet approach – many banks will accept precisely any non-sanctioned jurisdiction for the right amount of money and risk profile.

Having read, reviewed, and even written dozens of compliance manuals for banks and other financial institutions (payment processors, e-money) and financial and corporate service providers, it’s apparent that nations are not equal. To financial service providers, some nations are preferred over others.

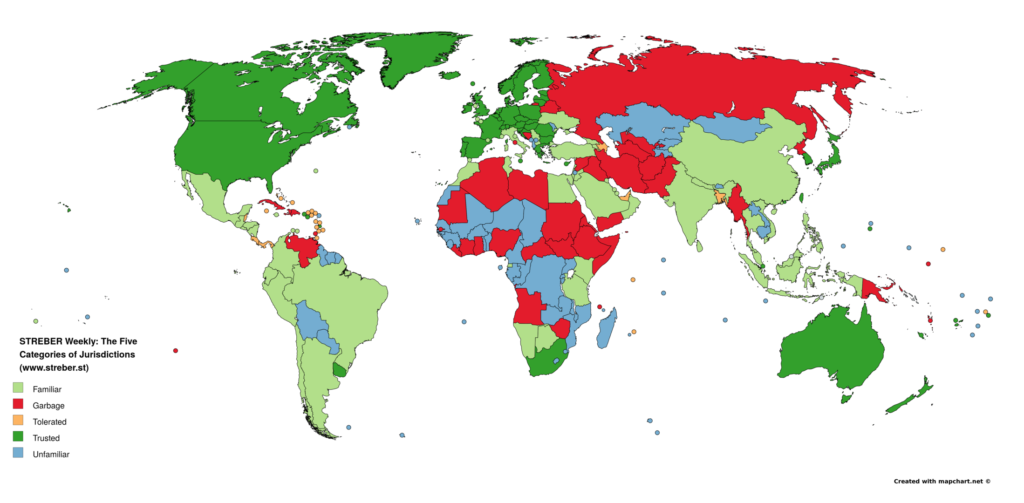

There are, by and large, five categories of jurisdictions. This refers to jurisdiction of incorporation, residence and citizenship (UBO, share holders, directors), banking, and even things like operations, customers, warehousing, web hosting, suppliers, and business partners. These categories are based on a a lot of different factors such as wealth, social and political stability, and international perception.

In this article, I will present these categories and the jurisdictions that go in them.

I’ll be painting with a broad brush here. Regional, political, cultural, economical, and other variations apply. There are also internal rankings. Some jurisdictions in a category can be favoured over others. As an example, Bulgaria falls into the Trusted category because it’s an EU jurisdiction, but there is no shortage of default suspicion against Bulgarian entities or persons.

While the categories may seem Eurocentric or Western-centric, what I’ve pieced together here is from businesses across the globe. A bank in Namibia isn’t more trusting of Nigeria than a Dutch bank might be.

Arguably, there aren’t five categories. There are only three: highly respected (Trusted), Tolerated, and Garbage. My inclusion of Familiar and Unknown are in the case of the former a middle-ground between Trusted and Tolerated and in the case of the former, somewhere between Tolerated and Garbage.

Trusted

The Trusted category consists of jurisdictions which are universally or almost universally viewed favourably internationally.

As you can probably guess, we’re talking about EU/EEA, Switzerland, USA, Canada, Australia, New Zealand, et cetera in this category.

Residents, citizens, and companies in these jurisdictions typically enjoy a more favourable risk assessment with banks, fiduciaries, and governments. There is a presumption of good character.

Familiar

These are nations for which a presumption of good character might not exist, but a presumption of bad character doesn’t apply either. These are jurisdictions which are familiar to most compliance officers. They have seen at least a dozen or so applications involving these jurisdictions have and have often find them to be good applications.

A higher degree of due diligence may be applied.

For companies, public registries are sometimes incomplete, missing, or of poor usability which means banks and others are more likely to insist on notarised copies of documents when that often isn’t the case in Trusted jurisdictions where company ownership can be fully verified online for free or for a small fee.

Applications are subject to more scrutiny.

Tolerated (Offshore)

This is an unspoken category. On paper, many banks and financial service providers will not engage with the likes of Seychelles and Belize, but almost always will for example take on a Seychelles IBC if the amount of money is attractive and character of the client is more favourable.

An EU resident and citizen with a Mauritius offshore company might find it easier to bank with a Maltese bank than resident and citizen of Indonesia.

These jurisdictions often lack public registries for companies or such registries are incomplete. However, there is frequent legitimate usage of offshore companies and banks are often well aware of how to handle and verify applicants involving these jurisdictions.

Applications involving these jurisdictions are often subject to additional screening. As a means to weed out unprofitable small fish, many banks ask for a much higher minimum deposit to take on clients (persons or corporates) from Tolerated jurisdictions. You might also be asked for additional reference letters or more in-depth proof of source of wealth/income.

Unfamiliar

These are jurisdictions which are usually assigned a higher level of risk due to primarily lack of familiarity. Poor international perception (high crime, corruption, war, political instability, et cetera), along with substandard (if any) transparency on company ownership and failure to meet international standards on compliance and cooperation.

This category may be the largest but it’s shrinking. Jurisdictions typically move from Unfamiliar to Garbage once it becomes clear how profoundly malfunctioning they are or to Familiar or even to Trusted.

Africa and Central Asia are home to most of these jurisdictions. I have found Bolivia, Paraguay, and some nations in South-East Asia also often fall into this category but specialized or regional banks often treat them differently (better).

In some cases, dealing with a local or regional financial service provider may be preferred as they may be more familiar with your jurisdiction than someone halfway across the globe.

Garbage

This category contains nations that are politically unstable, have severe sanctions imposed them, and generally poorly regarded internationally (very high crime, corruption, war-torn, totalitarian government, severely limited freedom of speech and press, et cetera).

It’s the most controversial category.

No bank will tell you that all residents of Pakistan are automatically bunched together with terrorist organizations and money launderers, but in the eyes of an average bank in a wealthy nation, it is a fact that income earned from an average or median Pakistani resident is far less than the fines and other compliance headaches associated with taking on one the aforementioned terrorists and money launderers that do exist in Pakistan.

Applications from these jurisdictions are often declined on the spot or subject to extreme scrutiny.

Map and List

The below is compiled from the aforementioned source materials: compliance manuals from banks, e-money institutes, financial and corporate service providers, fiduciaries, trusties, financial services regulators and other government bodies, and international organizations engaged in compliance and financial services. By having such a vast source material, the consolidated data on the one hand perhaps ends up being too vague and on the other hand has enough of a sample size to be relevant.

Trusted

- American Samoa

- Australia

- Austria

- Belgium

- Bulgaria

- Canada

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Estonia

- Faroe Islands

- Fiji

- Finland

- France

- Germany

- Greece

- Greenland

- Guam

- Hong Kong

- Hungary

- Iceland

- Ireland

- Japan

- Latvia

- Liechtenstein

- Lithuania

- Luxembourg

- Malta

- Martinique

- Netherlands

- New Caledonia

- New Zealand

- Norway

- Poland

- Portugal

- Puerto Rico

- Romania

- Singapore

- Slovakia

- Slovenia

- South Africa

- South Korea

- Spain

- Sweden

- Switzerland

- Taiwan

- United Kingdom

- United States

- Uruguay

- US Virgin Islands

Familiar

- Andorra

- Argentina

- Armenia

- Aruba

- Bahrain

- Bermuda

- Botswana

- Brazil

- Chile

- China

- Colombia

- Cook Islands

- Curacao

- Ecuador

- Egypt

- El Salvador

- Equatorial Guinea

- Georgia

- Gibraltar

- Guatemala

- Guernsey

- Honduras

- India

- Indonesia

- Isle of Man

- Israel

- Italy

- Jamaica

- Jersey

- Jordan

- Kenya

- Kuwait

- Lebanon

- Macau

- Macedonia

- Malaysia

- Mexico

- Monacco

- Morocco

- Namibia

- Nepal

- Nicaragua

- Oman

- Peru

- Philippines

- Qatar

- San Marino

- Saudi Arabia

- Serbia

- Sri Lanka

- Tanzania

- Thailand

- Tunisia

- Turkey

- Ukraine

- Vietnam

Tolerated

- Anguilla

- Antigua and Barbuda

- Azerbaijan

- Bahamas

- Bangladesh

- Barbados

- Belize

- British Virgin Islands

- Cayman Islands

- Costa Rica

- Dominica

- Marshall Islands

- Mauritius

- Montseratt

- Panama

- Samoa

- Seychelles

- St Kitts and Nevis

- St Lucia

- St Vincent and the Grenadines

- Trinidad and Tobago

- Turks and Caicos Islands

- United Arab Emirates

Unfamiliar

- Albania

- Benin

- Bhutan

- Bolivia

- British Indian Ocean Territory

- Burkina Faso

- Burundi

- Cambodia

- Cameroon

- Cape Verde

- Chad

- Christmas Island

- Cocos Islands

- Congo

- DR Congo

- Falkland Islands

- Federated States of Micronisia

- French Guiana

- French Polynesia

- French Southern and Antarctic Lands

- Gabon

- Guadeloupe

- Guinea

- Guinea Bissau

- Guyana

- Heard Island and McDonald Islands

- Kazakhstan

- Kiribati

- Kosovo

- Kyrgyzstan

- Laos

- Lesotho

- Madagascar

- Malawi

- Maldives

- Mali

- Mayote

- Moldova

- Mongolia

- Montenegro

- Mozambique

- Niger

- Niue

- Northern Mariana Islands

- Palau

- Paraguay

- Reunion

- Rwanda

- Sao Tome and Principe

- Senegal

- Sierra Leone

- South Georgia and the South Sandwich Islands

- St Helena

- St Pierre et Miquelon

- Suriname

- Swaziland

- Tajikistan

- Togo

- Tokelau

- Tonga

- Tuvalu

- Uganda

- Wallis and Futuna

- West Bank

- Western Sahara

- Zambia

Garbage

- Afghanistan

- Algeria

- Angola

- Belarus

- Bosnia and Herzegovina

- Central African Republic

- Comoros

- Cote d Ivoire

- Cuba

- Dominican Republic

- Eritrea

- Ethiopia

- Gambia

- Ghana

- Grenada

- Haiti

- Iran

- Iraq

- Liberia

- Libya

- Mauritania

- Myanmar

- Nauru

- Nigeria

- North Korea

- Pakistan

- Papua New Guinea

- Pitcairn Islands

- Russia

- Somalia

- South Sudan

- Sudan

- Syria

- Turkmenistan

- Uzbekistan

- Vanuatu

- Vatican

- Venezuela

- Yemen

- Zimbabwe

Special Cases

Some jurisdictions are worth special note. I might update this section based on comments and discussions.

Azerbaijan

I listed Azerbaijan as Familiar because from the sources I was looking at, that’s where it on average would fit in. However, it is listed as Garbage (high-risk) in many cases.

Islands and Remote Territories

This applies in particular to France, whose overseas territories essentially are just an extension of mainland France. Technically, Guadeloupe is as French as any other region of France. Similar can be said about for example Guam and the US.

To some banks, this means that our example islands of Guadeloupe are treated equal with France (i.e. Trusted). However, some take a different approach and simply classify these islands and remote territories as risky or unfamiliar.

Middle East

This whole region is often classified as posing elevated risk, but there is so much trade and economic activity that many jurisdictions in the Middle East that many financial service providers are comfortable with the more stable nations.

Even a Familiar or Trusted jurisdiction in this region will very often be subject to scrutiny (due diligence) as if it were a Garbage jurisdiction.

Malaysia (Labuan)

While Malaysia is typically considered quite favourably (moderate risk), the island of Labuan is sometimes treated differently. This is akin to how the UK is Trusted but Bermuda is Familiar and Cayman Islands are Tolerated.

Russia

The biggest question mark in the Garbage category is probably Russia. Due to its profoundly unique standing internationally, Russia fits in both Familiar and Garbage on most banks’ compliance lists.

Sanctions come and go. Crime and corruption are huge problems. But Russia is big and there is a lot of trade to and from Russia, so it’s in a sense Garbage that’s very Familiar.

USA

Because of FATCA, the USA is both highly compliant but also a compliance headache. While there is a presumption of good character for American natural persons, the compliance cost has until recently been prohibitive to many banks. This is easing up, with banks being more likely to take on Americans once they sign the adequate forms to enable disclosure.

However, some banks still struggle with FATCA compliance and turn down all or at least non-HNWI Americans.

See also Offshore, USA.

Out of curiosity, what are the reasons for Bosnia to be there in garbage. I am originally from there, but live for a long time in the EU, but what I see over the past few years is, that trading and working with a company registered there is no issue and they even have only a 10% tax on foreign investments. Really no “patriot” thing here, just trying to understand the point of view. Thanks and great to read you again!

Bosnia and Herzegovina’s reputational problems stem from its poor AML and CFT (counter financing of terrorism) controls, as noted by MONEYVAL. Laws are being improved albeit slowly, and actual implementation (enforcement) of these laws remains lax.

http://www.coe.int/t/dghl/monitoring/moneyval/Countries/BH_en.asp

I would be surprised if I did this meta analysis again in a few years and Bosnia and Herzegovina is still Garbage. It’ll probably have moved up by then as laws and enforcement reach international standards.

MONEYVAL shares this positive outlook on the jurisdiction, and banks and financial service providers in Europe listen very closely to MONEYVAL. If I go back to the source material for this article, I would probably find that there is a big difference between how Bosnia and Herzegovina is viewed inside of Europe and how it is viewed in the rest of the world.

As someone who is on-boarding the citizens of Azerbaijan with Luxembourgish and Lichtenstein banks on regular basis – I share the sentiment that their background is quite tolerated from KYC perspective.

My assumption is that typically their wealth is generated through US and British oil companies or their sub-contractors which does not pose as many questions as potentially-Russia-linked counteragents in Belarus.

This could explain the double-standards.

Dear Streber!

First of all, happy new year! It’s good to have you back!

I would have few quick questions and would like to hear your opinion about it.

According to the corporate tax laws in Monaco, only retail and/or commercial companies has to pay taxes. I haven an LLC in the US that I’m using to be able access the US brokers and banks and this entity holds my stocks in publicly listed companies and sometimes I trade a bit. I don’t see any retail or commercial activity here, what’s your opinion?

I also have a company in Malaysia that I’m using to invoice (consultancy and advisory fees) my US LLC. The Malaysian company’s activities are restricted this only so I don’t see any retail or commercial activity here either. What’s your opinion?

What makes this whole thing even more complicated and raises another question is the fact that I put my Panamanian address with the US banks and brokerage firm while I’m using my Malaysian address for my Malaysian company and Malaysian business bank accounts. I’m also using my Monaco address for my European personal bank accounts. As far as I know if the above mentioned activities are not deemed to be retail or commercial then I don’t break any laws because it would be tax free in Monaco anyway. However today I was wondering whether it’s money laundering or not? Obviously if anyone would question my place of residency and the source of funds then I could show that it comes from dividends and investment income from my US LLC which pays fees to my Malaysian entity which in turn pays me dividends that I receive in Monaco so I don’t see any wrongdoing here, still I’m a bit worried. Technically I’m telling the truth because I’m a lawful resident in all the three countries and I rent a flat in all of them. I’m doing this by the way because I don’t want anyone to know that how much I have/earn.

What’s your opinion? It’s needless to warn me that you don’t give any legal or tax advise. I know. I just want to hear your personal opinion.

I’ll be waiting for your answer and let me tell you that, it’s really great that you’re blogging again! You’re the best Sir!

I know you’re phrasing this as if you are asking for my personal opinion but my answers would still be to questions that are legal in nature. You have a pretty complicated structure. Hopefully you have had legal expertise review it, or are you are going to.

Now, you wouldn’t be the first person in Monaco to run a foreign personal investment vehicle and living off of what’s essentially tax-free capital gains, but there’s usually a ton more to every story than is summarized briefly in an introductory message so it’s extremely hard to be specific.

The exact nature of the situation might end up depending on how you pay yourself from the LLC (via the Malaysia company) and whether the investments can be construed as retail activity. And that’s if someone in Monaco ever decides to investigate you, which they generally do not do as long as you fit into society there.

I’m not sure I see any significant risks of your structure, as described, being engaged in money laundering. But you do mention “my Malaysian address” and “my Panamanian address”, which definitely raises an eyebrow. If you have given banks false information about where you live, a worst-case scenario is that you are defrauding the bank and the bank may in such a case have every right to freeze your account and hold on to the money until a local court says otherwise. Most likely, they’d give you ample opportunity to update your address to wherever you actually do live.

But short of fraud or tax evasion (i.e. using proceeds from tax evasion, which can be a predicate crime to money laundering in many jurisdictions), your situation is probably not particularly dire. Broadly speaking, I think you may have set up an unnecessarily complicated structure, unless you actually spend significant time in Panama or Malaysia and have reasons for having company and addresses there. I’m not necessarily saying that you should go ahead and consolidate and simplify, but maybe take a moment to consider the pros and cons of doing so. I’ve just seen so many people in similar situations set up webs of companies and bank accounts, paying thousands in upkeep costs, for benefits that could be reaped with far less complicated structured.

All the best!

“but there’s usually a ton more to every story”

In this case there isn’t. My Nevada LLC has a bank account with BofA and Citi and a brokerage account with InteractiveBrokers. That’s it. Investing and trading with shares, bonds, options and currencies. It’s a personal investment company, just like you said. I guess it’s not retail nor commercial. What if they would say that it’s trading and not investing? In your opinion would that make my income commerical or retail in nature? It’s still my money only, it’s not a hedge fund, just a company with my funds without employees.

“how you pay yourself from the LLC (via the Malaysia company) and whether the investments can be construed as retail activity”

The Malaysian company invoices my US LLC for consultancy fees and the US LLC transfers the amount from BofA or Citi to Maybank in Kuala Lumpur. Then the Malaysian company pays me dividends to my European bank accounts. It’s important to note that the Malaysian company exists only to invoice my US LLC thus it has no other income and it has no employees.

“If you have given banks false information about where you live”

In my opinion I didn’t because I have a legal residence in all the three countries, I rent a home in all of them, I have utilities on my name in all of them, I have a mobile phone, internet and everything I need in all of them and I do travel between the three places.

Thank you for your answer! By the way how often do you write posts these days? Every two weeks, every month? Well, I really miss the old banking index because I could see which bank opens accounts remotely but don’t get me wrong, I’m not complaining because your list of the banks is absolutely unique and priceless!

Enjoy your weekend!

It’s a dictatorship for one, whereas Ukraine isn’t.

Dear streber,

Could you please clarify why you have listed Belarus as garbage? While it is clear that the jurisdiction is not seen as an utmost trusted one, it could have been placed in the unfamiliar category. Is this due to ties with Russia? What is the difference in relation to other CIS member states such as Kazakhstan and Ukraine?

Looking forward to your answer,

Hi Vlad,

In the eyes of the compliance officers around the world, Belarus is a totalitarian state with little to no international economic activity, partly due to sanctions, whereas Kazakhstan certainly is problematic but not to the same degree.

To the same people, Ukraine is still a democratic country that isn’t subject to sanctions.

The purpose of the categorization is to mitigate risks posed both by the customer (i.e. a Kazakh resident/citizen) and posed by the regulators (i.e. getting slapped with fines and penalties for trading with a Belorussian business).

While I could totally understand that a country perceived to be undemocratic by western standards disqualifies for being a trusted one, I still cannot pin-point the exact deal breaker, as several jurisdictions scoring equally worse or fare worse at the Economist’s Democracy Index for some reason got the “familiar” or “unfamiliar” labels. Think of Kazakhstan, Azerbaijan and Saudi-Arabia.

– Is it the low volume of international transactions –although the share of Kazakhstan and Azerbaijan is probably not much larger– or are the sanctions making the difference? ;

– Does the number of sanctions matter –They have been largely lifted after last presidential elections– or is it the existence of sanctions that disqualify a jurisdiction? ;

– I noticed the Austrian Raiffeisen Group is holding a 87,74% share in “Priorbank”, one of the main commercial banks in Belarus. Why would a large banking group from a highly respected jurisdiction invest in such an untrusted jurisdiction?

A lot of questions, I hope you do not mind answering them. This is a very interesting topic, but in certain cases probably very hard to understand.

There isn’t really one pinpointable deal breaker that makes Belarus regarded worse than Kazakhstan, Azerbaijan, and Saudi Arabia. There are multiple factors that when combined leads to Belarus being considered higher risk than Kazakhstan, Azerbaijan, and Saudi Arabia. It’s about international perception of the jurisdiction and the level of trust and confidence placed in it.

I specifically touch on Azerbaijan and the Middle East in the post.

– Low or narrow international economic activity is certainly one factor. Sanctions may have been lifted but the reputational fallout from them linger for much longer. Lifting sanctions isn’t so much an act of endorsement as it is a removal of active penalties.

– Sanctions leave a reputational mark. While a lifted sanction may mean certain transactions are not explicitly prohibited anymore, the fact that the jurisdiction was subject to such sanction causes a bitter taste when reviewing financial services applications from the jurisdiction. This can affect the likelihood of an application being approved.

– While I can’t answer for the board of directors and shareholders of Raiffeisen, it fits their profile. In addition to Belarus, Raiffeisen is present in a number of other higher-risk territories (such as Kosovo and Bosnia-Herzegovina). Entering these type of jurisdictions is a part of their strategy. They have found a way to make it work.