At long last, it is finally the Seychelles’ turn to be dissected and examined.

At long last, it is finally the Seychelles’ turn to be dissected and examined.

Its reputation is among the worst in the industry. Few surpass it: Nauru, Comoros, Liberia, and maybe Vanuatu.

What may superficially look like just another IBC jurisdiction with an international banking act actually has some interesting solutions to offer.

But it’s not all bad.

Overview

Similar to Belize, Seychelles has major problems and shortcomings when it comes to anti-money laundering and the efforts to combat tax evasion are very barebones.

Belize and Seychelles are some of the cheapest jurisdictions to incorporate in and IBCs in these jurisdictions are pushed heavily by marketers on online communities.

Because these jurisdictions are so popular and because it is relatively easy to become a licensed registered agent there, competition has grown fierce, costs have gone down, and it’s easy to start a reselling business and still offer attractive pricing while raking in a nice margin. See Things You May Not Know About Your OSP.

ESAAMLG

Seychelles is a member of ESAAMLG – Eastern and Southern Africa Anti-Money Laundering Group. So far, only one mutual evaluation has been performed on the Seychelles. It faced significant resistance from Seychellois authorities and market operators, which were very reluctant to share information.

In this report, which relied on data from 2005 and 2006, there were over 30,000 IBCs incorporated in the Seychelles and the offshore industry generated more than 25 million USD in revenue per year. For a country with a GDP of around 2 billion USD, that is a significant source of income.

The Seychellois authorities claimed that the island nation is at little risk of money laundering since it’s so remote and its banking sector not particularly large.

ESAAMLG points out in its report that corporate service providers (CSPs), despite legally required to, often do not know the beneficial owner of IBCs, especially for IBCs sold through overseas resellers/intermediaries. The report also states that there is very poor definition of what constitutes a beneficial owner.

In general, significant gaps were identified concerning due diligence.

OECD

In its 2013 peer review, the OECD has classified the Seychelles as non-compliant.

In this report, over 120,000 IBCs were reportedly incorporated in the Seychelles; 90,000 more than in ESAAMLG’s 2005/2006 report.

The OECD peer review reports echoes most of ESAAMLG’s concerns, showing that the Seychelles have taken little action to reach higher levels of compliance with international standards.

A sign of steadfast, unrelenting independence and defiance in true David-and-Goliath fashion where the Seychelles is David flinging rocks at the Goliaths of OECD and EAAMLG and, by extension, FATF? No, not really. There is simply more money to be made by remaining on the outskirts of compliance. Criminals need safe havens, too.

OECD stats that only a single request for information had been received as of writing. It is unclear if the Seychelles can and do share information.

Al-Jazeera – How to Rob Africa

In 2012, as OECD was wrapping up its peer review, Qatar-based news agency Al-Jazeera published a 25-minute documentary and article called How to Rob Africa. This article shone a light on what many already either knew or suspected was happening in the Seychelles: facilitation of various crimes in Africa such as transport blood diamonds and the usage of Seychellois companies to funnel money overseas.

In the Seychelles, we found how easy it is to rob Africa. We learned about the clever but brazen tricks and scams that can be used (for a fee) to disguise the origins of money and the identities of those who are moving it around.

The article was so damaging to the Seychelles that FSA Seychelles (at the time called SIBA – Seychelles International Business Authority) issued a press release promising to take action. Zen Offshore lost their license, which sent many resellers into turmoil.

The documentary has been viewed over 112,000 times on YouTube, which notably does not include views on the Al-Jazeera website.

Could the documentary have focused on other jurisdictions? Yes and no. Although I often talk about IBC jurisdiction as one cohesive, homogeneous collection of jurisdictions, each is unique when you break it down to the finer details.

While for example Liberia may on surface appear worse than Seychelles, its war-torn past and rampant corruption combined with a government-run registered agent system makes it less attractive for those seeking stability. Mauritius on the othr hand has far more stringent AML laws and actual controls than Seychelles, making it more of a tax haven than a money-laundering haven that the Seychelles is.

The practices shown in How to Rob Africa have not ended in the Seychelles, nor are they unique to this jurisdiction.

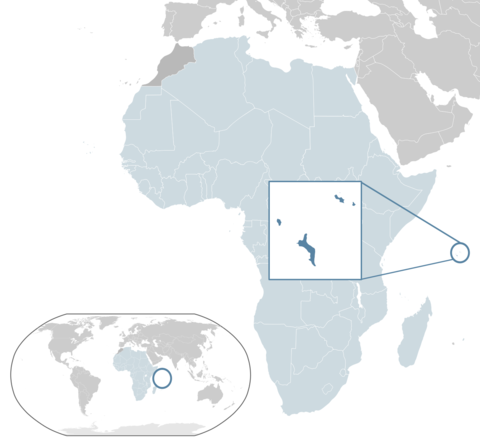

Geography and Demography

[table];

Full Name:;Republic of Seychelles

Official language(s):;English, French, Seychellois Creole

Other major languages:;None

Type of government:;Presidential republic

Area:;459 km²

Timezone:;UTC+4

Population:;92,000

GDP per capita:;15,000 USD

Currency:;Seychellois rupee (SCR)

[/table]Incorporation and Business

Reputation

We have already established that the Seychelles has a terrible reputation and it is one the jurisdiction has earned.

Out of the major, mainstream offshore jurisdictions, Seychelles has the worst reputation.

General Information

When it comes to company formation regulations and procedures, Seychelles is pretty much a standard IBC jurisdiction.

Regulator

Oversight of the offshore sector falls on the FSA Seychelles (formerly SIBA) as well as the FIU.

International Business Company (IBC)

Requirements are typical:

- One director required. Corporate directors permitted.

- One shareholder required. Corporate shareholders permitted.

- No paid up share capital required (usually 100,000 USD authorized).

- Registered address in Seychelles required.

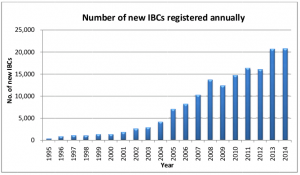

The Seychelles enacted its IBC act in 1994. It is one of the most popular IBC jurisdictions today due to low cost, quick set-up times, and strict secrecy. It is the bread and butter of the large-scale offshore incorporation sector.

Some 20,000 IBCs were formed each year 2014 and 2013. Despite the jurisdiction’s poor reputation, there are no signs of a slowdown. The FSA states in its 2014 annual report that the jurisdiction’s Non-Compliant rating may cause a decrease in companies set up by Eurozone investors but that they are seeing an increase what looks like Chinese companies (presumably based on the company name, which is the only detail automatically known to the FSA).

Taxation

None.

Record Keeping

Required but need not be submitted.

Companies Special License (CSL)

In 2003, Seychelles enacted a new law providing for companies to be formed with a special license to conduct restricted activities. A license can be issued for any activity.

- Investment management and advice

- Offshore banking (may require additional licensing)

- Offshore insurance (may require additional licensing)

- Reinsurance (may require additional licensing)

- Investment company

- Holding company

- Marketing company

- Intellectual property holding company

- Headquarters company

- Human resources (staffing) company

- Franchise company

- Business under an ITZ license (International Trade Zone)

Now, you might ask yourself if all Seychelles companies that act as for example investment or holding companies require a license. The answer is that no, they do not. However, for certain forms of tax planning, it might make sense to have a taxable entity. It is beyond the scope of this article to explain why but it has to do with being able to claim tax status in one jurisdiction to avoid it in another, under a double taxation treaty.

A Seychellois CSL is a double edged sword in that it can on the one hand provide for an arguably legitimate-looking taxable entity to be set up with some of the ease and advantages the Seychelles IBCs enjoy and on the other hand it can be used to conduct financial services or other licensed activities.

Requirements to apply for a CSL:

- Minimum two directors and due diligence documents on these directors.

- All directors must be natural persons.

- Corporate secretary required, which must be a licensed International Corporate Service Provider (ICSP).

- Business plan and detailed description of activities.

- Otherwise, same as IBC.

Record Keeping

Required and must be submitted.

Taxation

Global income is taxed at 1.5%.

Public Records

For IBCs, only company name is disclosed to the government.

For CSLs, company name and director details are disclosed to the government.

None of this information goes on public records.

Other

There are two other types of entities in the Seychelles: Limited Partnership (LP) and Protected Cell Companies (PCC). I don’t find either interesting enough to discuss in this article, though.

Seychelles International Trusts

Trust laws were enacted in 1994 (International Trusts Act, 1994) and are as rigid and secretive as one would expect. Disclosure is strictly regulated and forbidden in all situations except for specific Seychellois court proceedings.

With lower costs, it is trying to be an attractive alternative to more expensive jurisdictions. As of 2014, little more than 600 trusts had been declared.

International trusts may not be settled by residents of the Seychelles or have beneficiaries resident in the Seychelles. However, IBCs (and CSLs) can settle and benefit from trusts. The trustee must be resident and duly authorised by the Seychelles government to act as a trustee.

Fraudulent conveyance is limited to two years. Prevention of forced heirship is in place.

International trusts are exempt from taxation in the Seychelles.

Seychelles Foundations

Since 2009, the Seychellois arsenal of financial services also includes a Foundations Act. As of 2014, there are 421 foundations registered and active in the Seychelles.

It is one of the most affordable ways to form a foundation. Although the charter must be approved by the FSA, foundations are often formed with a pre-approved, generic charter and foundations can be established same or next day in many cases.

Contrary to Panaman where a foundation must have assets of at least 10,000 USD, the limit in the Seychelles is a mere 1 USD. Combined with low government fees, this can make Seychelles an attractive jurisdiction to establish a foundation.

Foundations are required to keep records but need not submit them. There is tax levied on foundations in the Seychelles.

Service Providers

As always, this is not a recommendation.

- Appleby (L)

- Icaza Law (L)

- Fidelity (L)

- Jordans Trust Company (L)

- Mossack & Fonseca (L)

- OCRA (L)

- OIL, Offshore Incorporations Limited (L)

- Sovereign Group (L)

- Sterling Offshore (L)

- Trident Trust (L)

Banking

Offshore banking in the Seychelles is generally poor and underdeveloped. It has the same problems as the Caribbean, with high fees, slow customer service, and lack of sophistication in services.

Barclays was for long the default bank for offshore companies in the Seychelles but after raising the minimum deposit from 5,000 to 100,000 USD and subsequently throwing out lower-value clients, attention turned to Bahraini-owned BMI Offshore. Barclays has since decided to completely leave the Seychelles offshore banking sector.

HoweveIn October, the Central Bank of Seychelles (CBS) issued a statement (Outward Transfer by BMI Offshore Bank (BMIO)) regarding BMI Offshore having problems with outgoing wire transfers. A few days prior, the bank had lost its foreign-currency correspondent accounts and, being an international bank, it would any way not be allowed to transact in the local currency.

Although the CBS assured the public that the bank was liquid, it and the FIU together started an investigation into the bank to help find a solution. In November, the CBS took control over of BMI Offshore after the bank had failed to establish new correspondent accounts.

In actions that put the Seychelles ahead of some dubious Caribbean counterparts (which we will discuss in a few weeks), the CBS was able to in by December 12th establish new correspondent accounts. However, doing so required the CBS to reorganize the bank. While this may be seen as a threat to sovereignty, the alternative would have left depositors stranded indefinitely. The bank did not yet resume normal operations but were able to process some transactions.

In February of 2015, it was announced that a representative of KPMG Mauritius – thereby no doubt leaning on the better reputation of Mauritius while still keeping it within Africa – would oversee the reorganization.

In August, the CBS announced that the reorganization plan had been approved as of June and the reorganization had resumed. Representatives of Al Salam Bank, which owns BMI Bahrain which is the parent of BMI Seychelles, visited the island and met with government officials.

As of writing, BMI Offshore is still not fully operational but seemingly will be in a matter of months.

So what other banks are there?

With the two mainstay banks being unavailable, Pakistani-owned Habib and the Seychelles branch of the Mauritian bank MCB are seeing an increase in applications.

Banking Secrecy

The Seychellois international banking act contains very strict secrecy clauses. Although OECD indicates that Seychellois authorities are empowered to force banks to disclose information, having seen first hand how things are run in the Seychelles, I would not be surprised if this turned out to be false when and if it is actually tested (beyond the very few requests received so far).

Banks in Seychelles

There are nine banks in the Seychelles:

- Bank AL Habib Limited

- Bank of Baroda

- Bank of Ceylon

- Barclays Bank (shutting down)

- BMI Offshore

- Habib Bank

- MCB

- Nouvobanq

- Seychelles Commercial Bank

Living in Seychelles

Under the Income and Non-Monetary Benefits Act, taxation on residents is relatively low, with personal income tax standing at 15% on income derived from local sources. Foreign income is usually not taxed.

It is costly but relatively easy to obtain permanent residence permit in Seychelles. A contribution of 1 million USD is required, plus an additional few thousand for administrative and application fees. This does not allow you to work for a Seychellois company but you can control a remote business.

A non-permanent residence permit can be obtained for circa 10,000 USD plus additional costs.

Costs of living are quite low but being a small island nation, imported items can get quite expensive.

The Seychelles is ones of the wealthiest nations in Africa. Despite a somewhat tumultuous history since gaining independence in 1976 (including a one-party socialist rule until 1991), the Seychelles is also one of the more politically and socially stable countries in Africa.

Weather conditions can get severe and it is one of the most remote locations with a sizable population.

Final words

The Seychelles is a highly secretive jurisdiction with a well-developed financial services sector, except for an underwhelming banking industry.

This secrecy comes at a reputational price, which – as circumstances dictate – may be worth it.

See also

- OECD Peer Review of Seychelles (also has a list of TIEA and DTA)

- Financial Secrecy Index Seychelles

- FATF documents on Seychelles

Hi Streber. I know I’ve found your site before, but now starting to dig in a bit. I host the Borderless Podcast, which we describe as “Traveling, Investing & Living Beyond Borders.” Our Borderless group has members in dozens of countries, and are especially interested in many of the things you write about. I’m getting that you’re not up for any consultations, and that you don’t publish your real name, but I wonder if you’d be open to a Skype interview some time soon. I’m guessing it will be helpful to get offshore insights from someone who has nothing to sell? Please let me know, and thanks in advance.

Hi JLockwood,

It’s a generous invitation, which I appreciate very much, but I have been asked this in the past and after mulling it then, deciding it is not something I wish to engage in.

Thanks

Streber

Understood. Well I’ll console myself by delving deeply into your site. You might be amused (or repulsed) by a piece I wrote recently about my attempt to get solid answers about these things. “So You Want an Offshore Strategy…” http://www.borderlessblog.com/want-offshore-strategy/